Senior care can be costly, and determining how to pay for it can be overwhelming. Financial planning for senior care helps you be well-informed and prepared for setting up and paying for any care you may need. It helps you be prepared instead of overwhelmed.

What are the financial considerations for seniors?

In addition to the typical financial considerations that everyone must cover, such as housing, utilities, transportation, and food, there are additional financial considerations for seniors, such as retirement savings withdrawal strategies.

The biggest financial considerations for seniors are care costs and estate planning.

Senior care costs

Seniors must consider their current and potential future healthcare and personal care costs, including:

- doctors visits

- physical or occupational therapy

- procedures or surgeries

- medications

- live-in facilities

- professional caregivers

It is also important to research and understand the tax implications for senior care costs.

Estate planning

Another important consideration for seniors is estate planning. This is not a pleasant subject for people to think about, but it is important to address.

Estate planning can involve:

- meeting with a lawyer and creating a will

- organizing where important documents and account information are at

- naming beneficiaries

- deciding on an executor for your estate

It can also be a good idea to pick someone who can act as your power of attorney and handle finances and decision-making if needed.

Finally, it is also important that you state your wishes for your future medical care by completing an advance directive and naming a medical power of attorney.

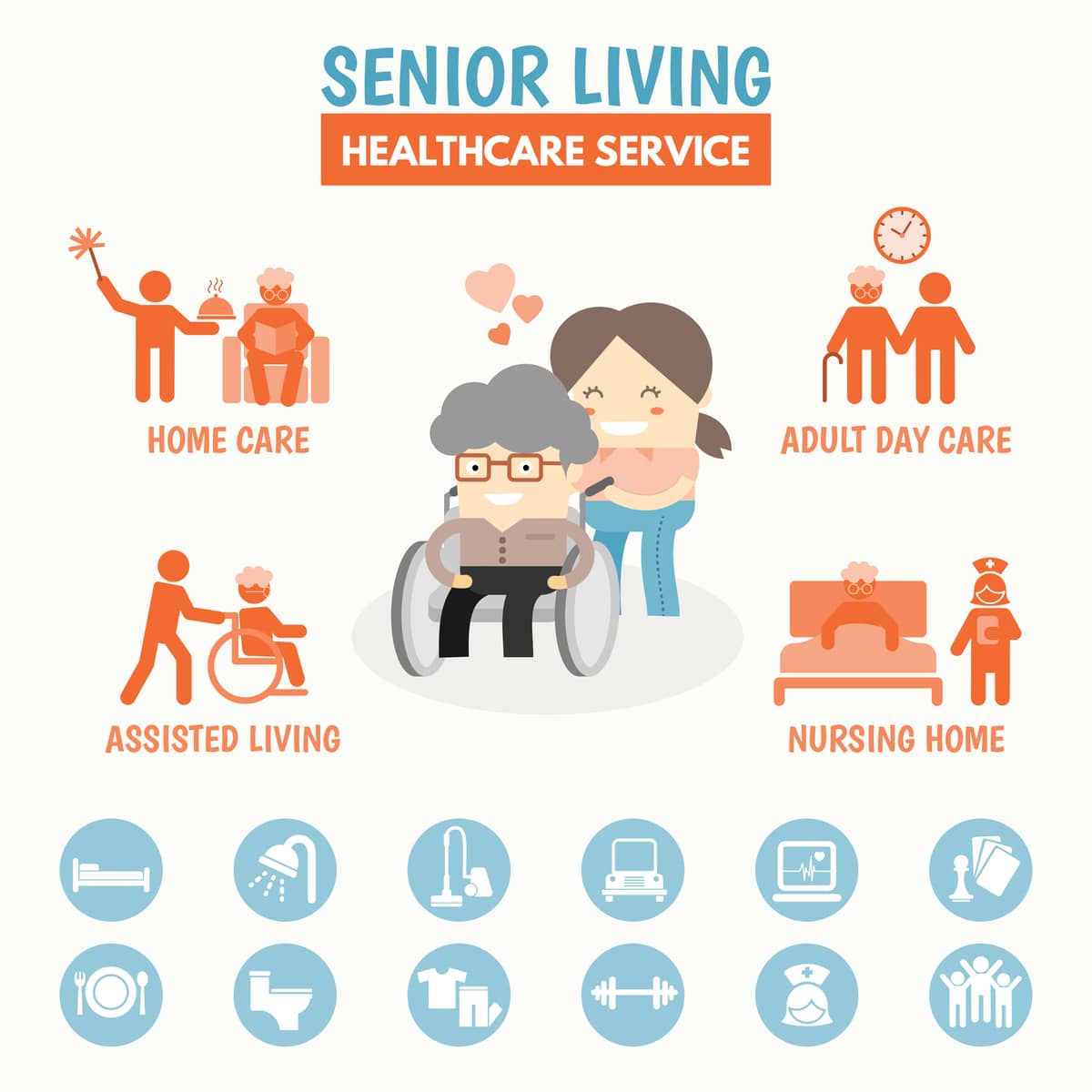

1. Understand senior care options

Whether you currently need care or are planning for the future, it is important to understand your senior care options.

There are 4 live-in options for seniors:

- Independent living communities (or retirement communities): Seniors rent apartments. The community offers social activities (and sometimes meal planning or transportation) but no medical help or personal care.

- Assisted living facilities: Seniors live in their own rooms/apartments. Social activities, personal care, and some medical care are offered.

- Memory care facilities: Seniors with Alzheimer’s or dementia receive specialized care and extra safety measures.

- Nursing homes: Seniors live in private or shared rooms. Social activities, personal care, all meals and housekeeping, and extensive medical care from nurses is provided.

Since these options include housing, they are more expensive.

Nursing homes provide the most care, so they are typically the most expensive. According to Genworth, the median monthly cost nationally is $8,669 for a semi-private room and $9,733 for a private room, and the median monthly cost in California is $11,406 for a semi-private room and $13,231 for a private room.

There are also 5 care options for seniors while they stay in their own homes and age in place.

- Family and friend caregivers

- Respite care: Temporary care is provided so the primary caregiver (typically family or friends) can get a break. Most live-in care facilities (such as assisted living and nursing homes) and home care providers offer respite care.

- Adult day programs: Centers provide seniors a safe place to go on weekdays to socialize and take classes.

- Home health care: Medical assistance provided at home, such as wound care or physical/occupational therapy.

- Home care (personal care): Non-medical care provided at home, such as personal care (help with things like moving around, eating, going to the bathroom, bathing, and grooming), companionship care, meal prep and housekeeping, and transportation.

These types of care are less expensive than live-in care but still have a large variance in price depending on the type of care and the amount of care needed.

Home care is typically the least expensive professional care option. According to Genworth, home care costs a median hourly rate of $30.00 nationally and $36.00 in California.

2. Review your financial situation and create a budget

Now that you know what you are planning for and the types of care available, you need to review your financial situation.

Start by listing your income and assets, including:

- income

- investments

- Social Security (check how much you are or will be getting each month)

- retirement accounts, such as 401K or IRA

- pension

- veteran’s benefits

- Supplemental Security Income (SSI)

Next, look at all your expenses and debts.

Look at both monthly expenses, such as housing, already established care, utilities, food, and transportation, and future expenses, such as additional care and medical expenses.

Create your budget. Make sure to prioritize essentials and look for potential ways to save.

3. Research available resources for financing care

There are many different ways to pay for senior care.

Health insurance

First, look into what your health insurance plan covers.

Income or assets

Seniors can use their income, investments, savings (including retirement accounts), social security, and pension to pay for care.

Government assistance programs

There are several government assistance programs that may help cover the costs of care. These include:

- veteran’s benefits

- Medicare

- Medicaid

- Supplemental Security Income (SSI)

- state programs

Who is eligible for these programs and what care they cover will vary, so be sure to do your research.

Additional financial options

There are other financial options that you can consider to help you pay for care, such as:

There is no general consensus on the recommendations for these options, so it is important to do your research for your situation.

Professional financial planning assistance

Another resource available is professional assistance to help you understand your options and decide how to finance your care.

You can look for free assistance offered by public agencies, such as social service agencies or private organizations. Look into local organizations and non-profits to see what resources they offer, such as information, workshops, or consultations.

You can also look into hiring a financial advisor/planner. There are many different types of financial advisors, including those specializing in eldercare, Medicaid, or veteran benefits.

There are also geriatric care specialists or managers who can help you coordinate care, including how to pay for it.

4. Review and update regularly

A big part of financial planning for senior care is to regularly review your financial situation and your care needs and update your budget accordingly. Stay informed about potential resources.

Hire Pacific Angels Home Care for personal care in California

Here at Pacific Angels Home Care, our experienced and kind caregivers offer personal care to help with all your activities of daily living, including moving around, eating, going to the bathroom, bathing, and grooming.

We can help with meal preparation, housekeeping, medication reminders, transportation, and companionship care.

We are available as needed, and we tailor our services to your care needs.

For those in the Aptos, Monterey Bay, or Santa Cruz area, give us a call today at (831) 708-2876 or reach us online to request a consultation for a tailor in-home senior care.

Grace Newman is a freelance writer for hire and tutor from Danville, Illinois. She is a recent graduate with a Bachelor of Science in Communication and was an editorial intern and editor for Parlia (a Wikipedia of opinions website). Currently, Grace writes about online education at her blog www.getsmartsoon.com. When she isn’t writing, she loves playing card games, having picnics, and binging her latest TV show obsession.

Previous Article

Previous Article Next Article

Next Article